Your Government 'Expects' Smaller Council Tax Rises

Mr Denham, Secretary of State for the Communities Department (the branch of Government that deals with Local Authority funding) then goes on to attack Conservative plans to increase funding from Central Government to fund council tax freezes.

The story is probably a response to this press release from the Government. In the notes to editors section, it helpfully points out that the Government is working towards freeing councils from 'strings-attached' funding and has moved £6Bn into non-ring-fenced funds (i.e. the Formula Grant).

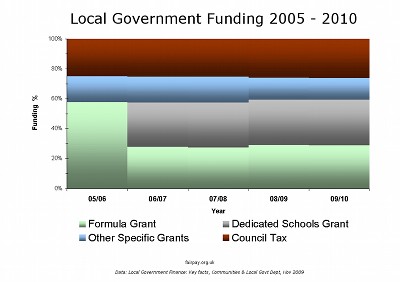

According to statistics published by the same department, the government moved £24Bn from the 'no-strings attached' formula grant in 2006, to help fund more targeted grants, mainly the Dedicated Schools Grant. Since then, at least two other targeted grants have been set up, including the Area Based Grant and Sure Start, Early Years and Childcare Grant, both set up in 2008. Total funding for these two grants stood at around £4Bn in 2009. In 2008, there were more than 60 targeted grants. About two-thirds of all government money to councils was in the form of these ring-fenced funds.

Council formula grant is recalculated every year according to a complex formula which may change each time. Here's the data on all councils' formula funding for 08/09

This graph shows the various sources of government funding outlined in the Communities Dept's statistics over the last 5 years - plus council tax. The formula grant includes money collected from business premises in business rates - this money is collected locally, and then redistributed nationally via the grant.

The source data goes into great depth regarding the funds from central government, but when it comes to overall income flowing to local government, the data is far less clear. Council income from charging for services, sale of assets, interest on savings and revenue from investments, etc, appear to be glossed over.

Given that central government expects reduced council tax (and seems to be getting it, at least at shire level - the resulting reduction in funding to lower-tier councils seems to be increasing tax at district/borough council level), then it appears that if councils want to continue their current levels of spend, they will have to draw in extra funds from this less accounted-for category. That would be charges for services or sale of assets. The other obvious local source of income would be business rates (and councils have powers to increase them), but as these are redistributed nationally, there is no incentive for councils to increase them, as it would likely decrease their popularity with little or no increase in funding.